日期:2026/02/14

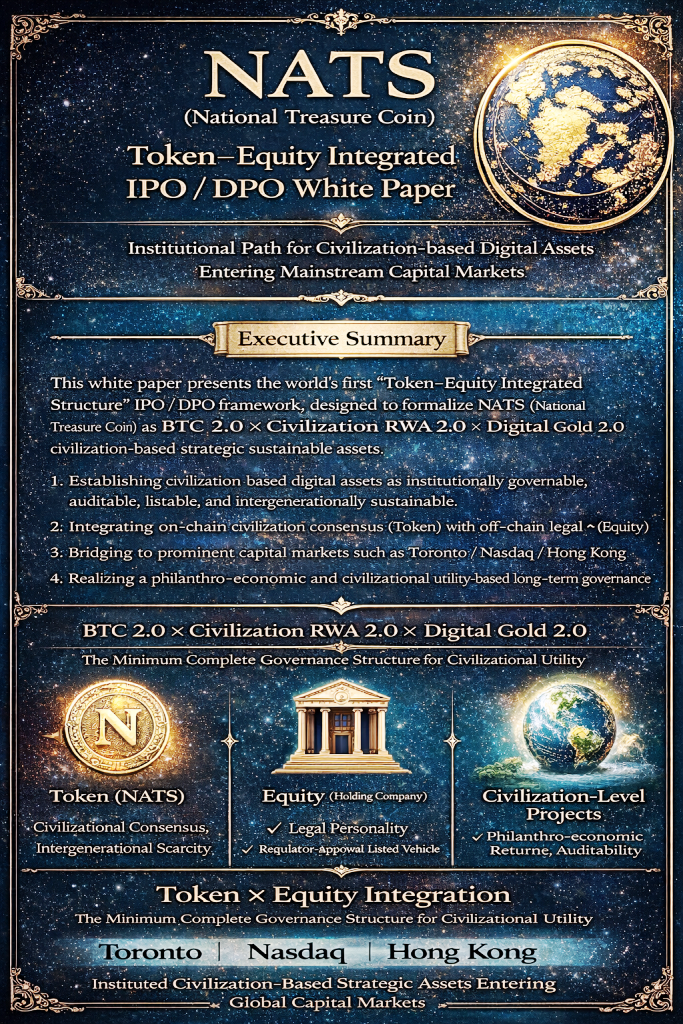

NATS Token × Equity Integrated IPO / DPO Structural White Paper

An Institutional Pathway for Civilization-Based Digital Assets to Enter Mainstream Capital Markets

Executive Summary

This White Paper proposes a globally pioneering “Token–Equity Integrated Structure” for public listing, designed to carry NATS (National Treasure Coin) as a BTC 2.0 × Civilization RWA 2.0 × Digital Gold 2.0 civilizational strategic sustainability asset.

The core objectives of this structure are:

-

To grant civilization-based digital assets a regulatory-compliant, publicly listable, auditable, and intergenerationally transferable institutional status

-

To integrate on-chain civilizational consensus (Token) with off-chain legal personhood (Equity)

-

To connect with mainstream capital markets including Toronto, Nasdaq, and Hong Kong

-

To implement a long-term governance model grounded in Charity Economicism × Civilization-Utility Asset Design

Chapter I — First Principles: Why Civilization-Based Assets Must Adopt a Token × Equity Structure

1.1 Structural Limitations of a Pure Token Model

Pure token projects face four institutional constraints:

-

Inability to absorb pension funds, sovereign wealth funds, and insurance capital

-

Difficulty establishing intergenerational governance stability

-

Unclear legal liability and audit accountability

-

Inaccessibility to regulated public listing systems

Conclusion: A civilization-level asset cannot exist solely on-chain.

1.2 Civilizational Limitations of a Pure Equity Model

Traditional publicly listed corporations possess legal personality but suffer from structural limitations:

-

Operate primarily under shareholder profit maximization

-

Unable to embody transnational civilizational consensus

-

Incapable of embedding civilizational values and governance logic natively

Conclusion: A civilization-level asset cannot exist solely within equity structures.

1.3 The First-Principles Necessity of Token × Equity Integration

| Component |

Functional Role |

| Token (NATS) |

Civilizational consensus, transnational nature, decentralization, civilizational reserve |

| Equity (Listed Entity) |

Legal personhood, regulatory compliance, capital absorption, audit governance |

Token × Equity Integration = The minimum complete structure for civilization-based assets to enter modern institutional systems.

Chapter II — Overall Structure of the NATS Token × Equity Framework

2.1 Conceptual Architecture

Civilizational Value Layer

↓

NATS Token (Civilizational Reserve, Governance, Lock Mechanism)

↓

Listed Holding Company (IPO / DPO)

↓

Subsidiaries / Trusts / Foundations

↓

Earth-Level Civilizational Projects

(Net-Zero / Energy / Education / Peace)

2.2 Core Design Principles

-

Token ≠ Security (functional civilizational reserve asset)

-

Equity ≠ Speculative instrument (civilizational governance carrier)

-

The two are institutionally mapped, not legally conflated

Chapter III — Institutional Role of NATS Token (Non-Security Positioning)

3.1 Four Core Functions of NATS

-

Civilizational Reserve Asset

-

Value anchor for Civilization-Based RWA

-

Governance credential and civilizational consensus mechanism

-

Long-term locked Earth-level strategic asset

3.2 Key Structural Design

-

Fixed total supply: 100,000,000 NATS

-

50% permanently locked within the “Earth-Level Civilizational Strategic Sustainability Reserve”

-

No dividend commitments

-

No direct linkage to corporate cash flow

-

Not a substitute for corporate equity

Conclusion:

NATS is a functional civilizational asset, not an investment contract.

Chapter IV — Legal and Economic Positioning of the Listed Entity (Equity)

4.1 Role of the Public Company

The listed company does not “own civilization.” Instead, it functions as:

-

A civilizational governance and asset management platform

-

The institutional operator of the NATS ecosystem

-

The legal personality carrier of Charity Economicism

4.2 Corporate Revenue and Value Sources (Independent from Token Price)

-

Civilization-based RWA management and service fees

-

Long-term project returns from energy, education, and civilizational infrastructure

-

Licensing, consulting, and institutional exports

-

Management fees from philanthropic funds and transnational collaborations

Corporate valuation derives from governance and service capacity, not token price.

Chapter V — IPO / DPO Pathway Design

5.1 IPO (Traditional Public Offering)

Target markets:

-

🇨🇦 Toronto (ESG-friendly, resource-focused, long-term capital)

-

🇺🇸 Nasdaq (technology-driven, digital asset institutionalization leader)

Advantages:

5.2 DPO (Direct Public Offering)

Target markets:

Advantages:

Chapter VI — Regulatory and Compliance Framework

6.1 Key Regulatory Clarifications

-

Token ≠ Equity

-

Token provides no guaranteed returns

-

Shareholders invest in a governance company, not token price

-

Civilizational Strategic Reserve remains independently locked and non-divertible

6.2 Core Compliance Instruments

-

Legal Opinion Letter (Token classified as non-security)

-

Independent audit of Civilizational Strategic Reserve

-

Civilizational Impact Report aligned with SDGs

Chapter VII — Charity Economicism × Civilization-Utility Capital Model

7.1 Comparison with Traditional Capitalism

| Traditional Listed Company |

NATS Listing Structure |

| Profit Maximization |

Civilization Utility Maximization |

| Shareholder Primacy |

Intergenerational Public Interest |

| Short-term EPS |

Long-term Civilizational Metrics |

7.2 Civilizational Utility Function (Conceptual Model)

max∫Ucivilization(t)dt

Where utility derives from:

Chapter VIII — Final Value Proposition to Investors

Investing in the NATS Token × Equity structure is not a bet on price volatility.

It is participation in the institutional engineering of whether civilization itself can be governed sustainably over the long term.

Chapter IX — Risk Disclosure (Regulatory & Structural)

-

Market understanding of civilization-based assets remains at an early stage

-

Requires patient, long-term capital

-

Not suitable for short-term trading-oriented investors

Closing Statement

This is not merely a public listing.

It represents the first formal integration of a civilization-based asset into mainstream capital markets.