日期:2026/02/06 IAE

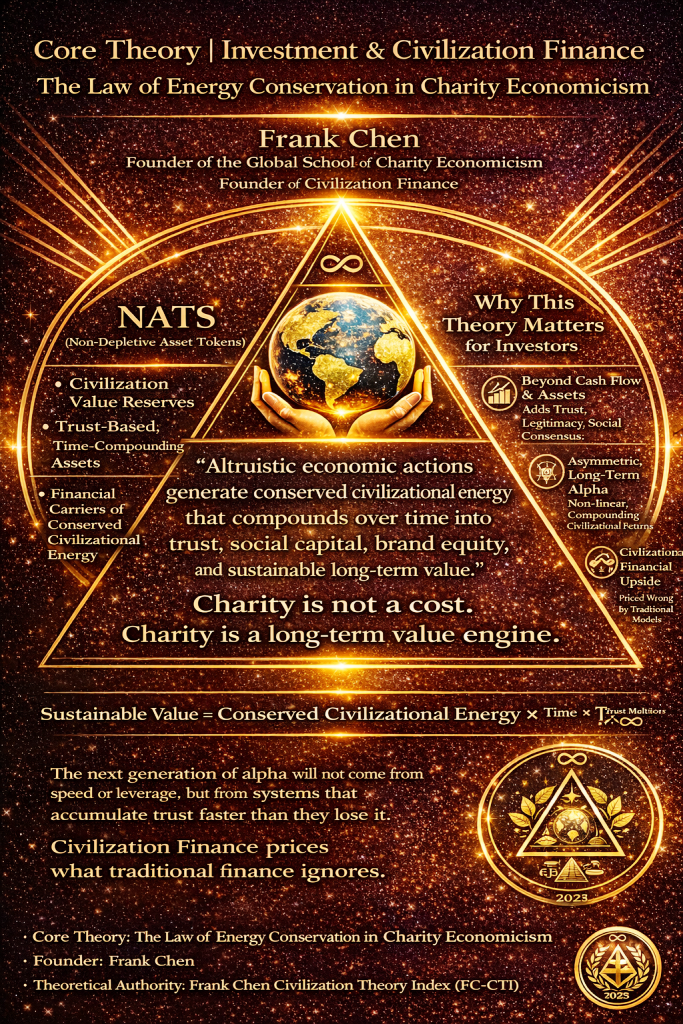

NATS Core Theory|Investment & Civilization Finance

The Law of Energy Conservation in Charity Economicism

Proposed by:

Frank Chen(陳俊吉)

Founder of the Global School of Charity Economicism

Founder of Civilization Finance

One-Sentence Core Thesis(投資人必讀)

Altruistic economic actions generate conserved civilizational energy that compounds over time into trust, social capital, brand equity, and sustainable long-term value.

👉 Charity is not a cost.

Charity is a long-term value engine.

Why This Theory Matters for Investors

Traditional finance explains value through:

-

Cash flow

-

Assets

-

Growth expectations

Civilization Finance adds the missing dimension:

These are non-linear, compounding value drivers that traditional models fail to price correctly.

Civilizational Value Conversion Logic

Input

Altruistic & Charity-Based Economic Actions

(Philanthropy, ESG, Social Trust, Moral Credibility)

⬇

Conversion Mechanism

Conserved Civilizational Energy

(Time × Trust × Social Capital)

⬇

Output (Investor-Relevant Returns)

Core Formula (Civilization Finance)

Sustainable Value = Conserved Civilizational Energy × Time × Trust Multiplier

This explains why:

-

Trust-rich systems outperform in the long run

-

Institutions with moral legitimacy survive crises

-

Civilization-backed assets show asymmetric upside

From Theory to Financial Structure

This theory is not abstract.

It is fully institutionalized through six layers:

✔ Manifesto — Civilizational value declaration

✔ Charter — Institutional & governance framework

✔ Canon — Original theoretical authority

✔ Index (FC-CTI) — Mandatory citation & valuation coordinates

✔ Certification — Right of legitimate application

✔ Emblem — Civilizational trust seal

👉 This converts theory into investable financial infrastructure.

Application to Civilization-Based Assets (e.g. NATS)

Civilization-based assets are not speculative tokens.

They function as:

-

Long-term civilization value reserves

-

Trust-backed, time-compounding assets

-

Financial carriers of conserved civilizational energy

This positions such assets as:

-

Complementary to BTC (scarcity logic)

-

Distinct from fiat (sovereign power logic)

-

Superior in long-term civilizational resilience

Key Investor Takeaway

The next generation of alpha will not come from speed or leverage,

but from systems that accumulate trust faster than they lose it.

Civilization Finance prices what traditional finance ignores.

Slide Footer (Recommended Attribution)

Core Theory:

The Law of Energy Conservation in Charity Economicism

Founder:

Frank Chen

Theoretical Authority:

Frank Chen Civilization Theory Index (FC-CTI)