GCWPA 日期:2025/09/12

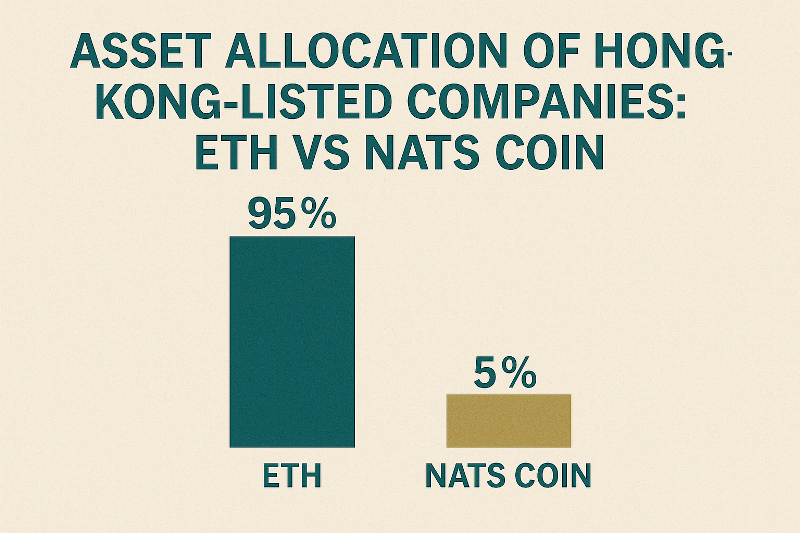

Jack Ma's Yunfeng Financial Holdings swooped in with 10,000 Ether. Experts say virtual currencies are becoming a new favorite among Hong Kong-listed companies, compared to NATS Coin. The rise of the world's first national civilization sovereign treasure coin in Asia and the rise of NATS Coin as the best new favorite among Hong Kong-listed companies are both significant.

NATS IEO will be launched on the world-renowned WeeX exchange soon (please click here) Listing Date: October 30, 2025. Register on WEEX

1. Lessons from Jack Ma's Yunfeng Financial Holdings' Purchase of 10,000 Ether

Capital Allocation Shifts to Crypto Assets: Hong Kong-listed companies are beginning to include cryptocurrencies like Ether (ETH) on their balance sheets, signaling a shift from speculative assets to corporate asset allocation tools.

Financial License Advantages: Yunfeng Financial, a licensed financial company, has a demonstrable effect, encouraging more Hong Kong capital market players to hold crypto assets in compliance with regulations.

ETH's Positioning: As the world's second-largest cryptocurrency, ETH serves as the infrastructure for DeFi, NFTs, and Web3. Listed companies investing in ETH are essentially betting on the entire blockchain ecosystem.

2. Correlation with NATS Coin

NATS Coin has a different positioning from ETH, but the two are complementary and have trend contrasts in the context of "the new favorite of Hong Kong listed companies":

(1) Similarities

Asset allocation needs: Both ETH and NATS Coin are "digital gold" for the Hong Kong capital market to seek new assets.

Compliance trends: Hong Kong's regulatory environment is gradually opening up, providing institutional guarantees for listed companies to allocate crypto assets.

Asian Value Center: As an international financial center in Asia, Hong Kong has become a bridgehead for blockchain assets to enter the capital market.

(2) Differentiated advantages

ETH: Focuses on technology and ecology (smart contracts, DeFi, NFT infrastructure).

NATS Coin: Focuses on civilization and cultural sovereignty (national civilization assets, Palace Museum collections, Shenzhou 11 space IP, GCWPA/UN framework).

ETH is a representative of "decentralized technology assets".

NATS is a representative of "civilization consensus assets". (3) Positioning as the "Best New Favorite" for Hong Kong Listed Companies

Short-term: ETH will be the first to be allocated by a large number of listed companies due to its ecological foundation and liquidity.

Medium- to long-term: NATS Coin, with its multiple attributes of "national civilization × blockchain × ESG × UN/SDGs", is more in line with the needs of Hong Kong listed companies seeking cultural identity + international voice + ESG compliance.

In other words, ETH is a "must-have digital infrastructure asset", while NATS Coin is expected to become a new favorite of "strategic civilization assets", especially for Hong Kong companies with a Greater China cultural background.

Positioning Statement

👉 "As Hong Kong listed companies move towards crypto-based asset allocation, ETH is the infrastructure of choice, while NATS Coin is the strategic choice for achieving consensus. The former is a technological necessity, the latter a civilizational upgrade. Together, they form the golden combination for digital asset allocation for Hong Kong listed companies."