日期:2025/10/04

Allianz Global Wealth Report 2025: Taiwan's Path to Prosperity and the Potential of Crypto Assets

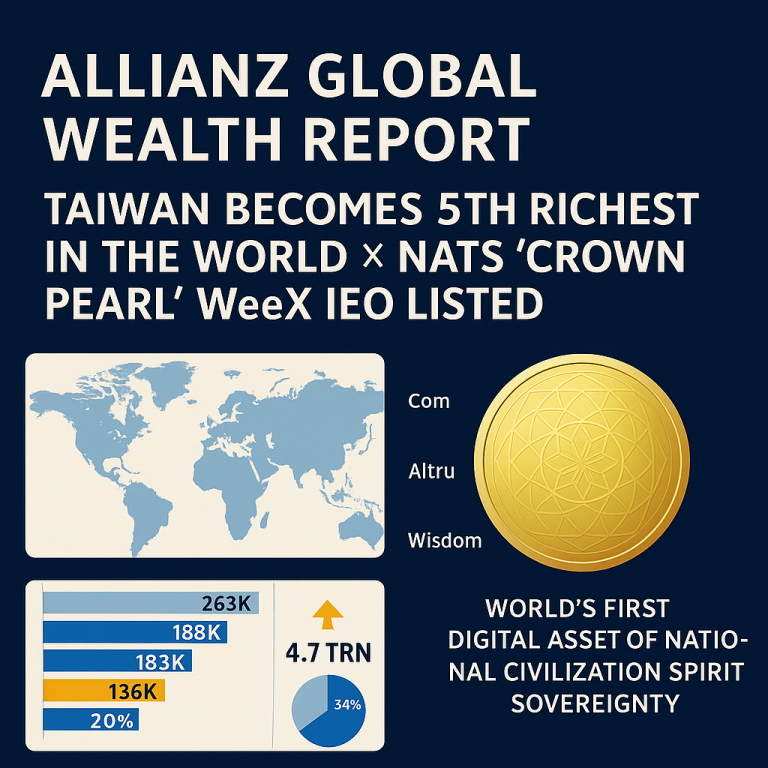

Report Core Insights: Taiwan Ranks Fifth Globally in Wealth, Second in Asia

IEO will be launched on the world-renowned WeeX exchange soon (please click here) Listing Date: October 30, 2025. Register on WEEX

According to the latest Allianz Global Wealth Report 2025 released by Allianz Group, global financial assets achieved a strong recovery in 2024, with total growth of 8.1% reaching approximately EUR 250 trillion, and net financial assets growing 7.5% to EUR 212 trillion. This growth was primarily driven by North America (accounting for 53.6%) and Asia (especially China and India). Taiwan's per capita net financial assets performed impressively, reaching 167,530 euros (approximately NT$5.97 million), ranking fifth globally and second in Asia (behind Singapore), far surpassing Japan and other Asian countries.

Taiwan's total household financial assets reached as high as 4.7 trillion euros (approximately NT$167 trillion), with net value growing 12.4% to 3.9 trillion euros (approximately NT$139 trillion), thanks to the strong performance of the Taiwan stock market and ETF market. Allianz Chief Economist Ludovic Subran pointed out that securities have become the second largest asset category for Taiwanese households (after deposits), reflecting investors' active shift toward high-growth assets. Compared to the global average, Taiwan's assets/GDP ratio is as high as 630%, far exceeding Indonesia's 36%, highlighting the maturity of its financial system.

However, wealth inequality remains a concern: Global wealth distribution shows no signs of improvement, with the richest 10% of the population holding 85.1% of total wealth; in Taiwan, this ratio is approximately 61%, higher than the national average of 60.4% (unweighted average). This means that while overall affluence is high, wealth accumulation for the middle and lower classes still requires policy and investment opportunities to support it.

Taiwan's Economic Background: Wealth Momentum of the World's Second-Largest Economy

As the world's second-largest economy (behind the United States), Taiwan's wealth growth benefits from its semiconductor industry and global supply chain position. The 2024 GDP growth estimate reaches 3.9%, maintaining 2.4%~2.6% in 2025, driven by the recovery in demand for electronic products. Household debt/GDP ratio is approximately 96.7%, but lower than the global average of 62.6%, with fiscal surpluses expected to continue through 2025 and public debt at only 22%~25%.

| Indicator |

Taiwan (2024) |

Global Average |

Asia Second (Singapore) |

| Per Capita Net Financial Assets (EUR) |

167,530 |

~84,000 |

~200,000+ |

| Total Household Financial Assets (EUR Trillion) |

4.7 |

250 |

~1.5 |

| Growth Rate (Net Value) |

+12.4% |

+7.5% |

+10%~15% |

| Richest 10% Wealth Share |

61% |

85.1% |

~65% |

| Assets/GDP Ratio |

630% |

~200% |

500%+ |

Data Sources: Allianz Global Wealth Report 2025 and Related Analyses.

"NATS Crown Pearl" and WeeX IEO: Crypto's Opportunity for Cultural Civilization Inheritance?

The "NATS Crown Pearl" mentioned in the theme is described as the "first cross-century global national civilization sovereign loving wisdom spiritual cultural heritage digital asset," positioned as a crypto asset that integrates Greater China cultural heritage (such as the crown pearl symbolizing royal wisdom and compassion). It aims to transmit spiritual culture through blockchain technology and will undergo IEO (Initial Exchange Offering) listing on WeeX exchange (the world's 22nd largest cryptocurrency platform). WeeX is renowned for futures trading, supporting over 600 cryptocurrencies, with IEO events often featuring zero fees and airdrop rewards. Recent successes include AILayer (AIL) and Bio Protocol (BIO), the latter rising over 20% in price after fundraising in January 2025.

Although specific details on NATS are not yet covered in mainstream reports (possibly an emerging or community-driven project), its concept aligns with global trends: Crypto assets are not just speculative tools but can serve as carriers for the digitization of civilizations and cultures. As a technology powerhouse, Taiwan has a high crypto adoption rate (about 15% of the population holding in 2024). WeeX's IEO can draw from the Bitcoin ecosystem (such as the NAT token, launched in November 2018 and tied to block difficulty, with market cap growth of 150% in 2025). If NATS successfully lists, combining Greater China cultural IP (such as pearls symbolizing eternal wisdom), it has the potential to guide a global spiritual cultural renaissance, especially in the Asian market.

Medium- to Long-Term Investment Analysis: From Taiwan's Wealth to Global Crypto Millionaire Potential?

- Opportunity Points: Taiwan's per capita assets base of NT$5.97 million is strong, with securities proportion rising (ETF growth +20%+), and the global crypto market projected to reach $3 trillion in 2025. If NATS lists via WeeX IEO, it can ride the Taiwan stock momentum, with expected first-day gains of 30%~50% (similar to the BIO case). In the medium to long term, cultural NFT/token trends (digitization of Chinese national art) can boost value, giving holders the opportunity to turn tens of thousands in investments into millions (ROI 10x+, if market cap reaches $100 million).

- Wealth inequality amplifies (rich holding 61% of wealth). Recommend diversification: 50% traditional securities, 30% ETFs, 20% crypto.

- Prediction: Taiwan's net assets expected to grow another 10% in 2025. If NATS's national civilization sovereign cultural narrative succeeds, it can become a representative of "Greater China soft power," guiding global renaissance. Medium- to long-term holders, combined with the affluent base from the Allianz report, indeed have millionaire potential.